What and why

The ESCAP Action Plan to Strengthen Regional Cooperation on Social Protection in Asia and the Pacific calls on governments to progressively design and realize comprehensive and sustainable social protection systems for all that enable every person to access social protection at adequate benefit levels. As such, governments should design inclusive systems that use one integrated system rather than separate, disconnected components.

How

Establish a social protection floor tailored to national circumstances and level of development that reflects the country’s vision for social protection (see Milestone 1). A social protection floor is a nationally defined set of basic income security schemes that prevent people from experiencing poverty, vulnerability and loss of income, as a result of normal life contingencies.

At the core of the social protection floor is the concept of inclusive life cycle social protection systems for all. Building a social protection floor requires governments to provide income security throughout the life cycle, with a focus on:

- Basic income security for children, providing access to nutrition, education, care and any other necessary goods and services, with support to cover additional expenses of life for children with disabilities;

- Basic income security for persons in active age who are unable to earn sufficient income, particularly in cases of sickness, unemployment, maternity/paternity, work injury, chronic illness and disability; and

- Basic income security for older persons, with support to cover additional expenses of life for older persons with disabilities.

A system of carefully designed schemes that address key risks throughout the life cycle can keep people out of poverty throughout their life if coverage is universal and benefit levels are adequate.

A system of life cycle schemes (see Figure 3-1), including universal child benefits, parental benefits, unemployment benefits, disability benefits, work injury and old age pensions can adequately ensure protection for all women, men, girls, and boys throughout their life.

FIGURE 3‑1 Ideal and inclusive life cycle social protection system

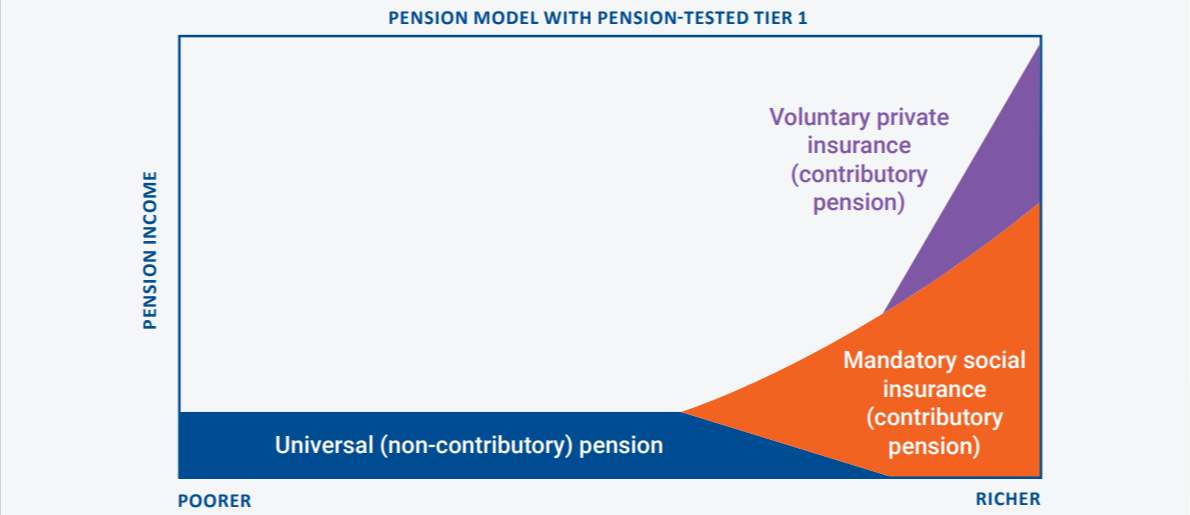

Through this life cycle approach, each scheme forms an important piece of a universal social protection system that will eventually cover all risks and contingencies throughout life. This is best achieved through a combination of non-contributory (often financed through general tax revenues) and contributory (often financed through direct contributions from employees and employers) schemes that together ensure universal coverage by design. Most modern, comprehensive systems exhibit this two-pronged design. In high- or middle-income countries, non-contributory schemes often consist of child, maternity, disability and old-age benefits, complemented by a range of contributory schemes for working age adults, such as unemployment, parental and sickness benefits, work injury and old age pensions, which together achieve universal coverage. For example, old-age pension systems can ensure that those who were unable to work, or worked in the informal sector, have access to a minimum non-contributory pension once they reach old age, while workers in the formal sector who contribute a portion of their income to a social insurance pension scheme can receive a higher pension benefit based on their contribution once they retire. To maintain incentives for enrolment in a contributory scheme, benefits should exceed those from the non contributory pension. This may be achieved using a benefit-tested approach in which the non-contributory pension is tapered (see Figure 3-2).

FIGURE 3‑2 Blended universal old-age pension

A universal life cycle social protection system can be built incrementally to achieve full coverage and adequate benefit levels. Many countries in Asia and the Pacific, and indeed elsewhere in the world, have chosen to build core life cycle social protection schemes incrementally, often starting with an old-age pension. Over time, governments often continue with additional schemes. For example, while an ideal child benefit option should provide all families with children aged 0-18 with a child benefit, governments can start with children 0-5 years of age, covering the initial years of life when access to nutrition is of highest importance. Eligibility can then easily be shifted to higher ages through keeping children on the scheme as they age. Increasing the age of eligibility or benefit levels are simple design tweaks that do not require any changes to targeting methodology, or other implementation processes.

Benefit levels from contributory schemes will depend on the size and duration of the contributions as well as the accrual rates. When defining benefit levels for a specific non-contributory scheme, however, governments should consider the following:

- Nationally defined minimum levels of income can correspond to the monetary value of a set of necessary goods and services, national poverty lines, income or other comparable thresholds established by national law or practice.

- Benefit levels will also vary depending on the life cycle contingency being addressed. For example, the level of a child benefit should be designed to ensure access to nutrition, education and care.

- The level of benefit is also a political decision that factors in the allocation of existing government resources and the political economy of the design of social protection schemes.

- To ensure that benefit levels do not lose their value and relevance over time, a common practice is to index benefits, for example, to the Consumer Price Index, or similar well-established parameters. The level of benefits should be regularly reviewed through a transparent monitoring procedure that is established by national laws. Governments should also establish feedback mechanisms, including grievances mechanisms (Milestone 8) to inform decisions on benefit level adjustments.

As initial levels of investment in social protection schemes can be limited, it is often important to incrementally expand benefit levels over time, or when additional resources become available.