How to finance inclusive social protection

Manuals and Training Materials

01 January 2018

• SOCIAL PROTECTION AS A SOCIAL CONTRACT;

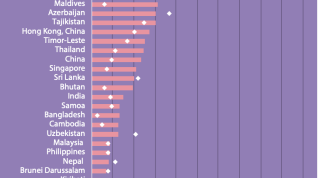

• CURRENT INVESTMENTS IN SOCIAL PROTECTION IN ASIA AND THE PACIFIC ARE LOW BUT INCREASING;

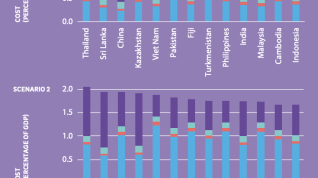

• INVESTING TO CLOSE GAPS IN SOCIAL PROTECTION COVERAGE

• HOW TO INCREASE THE FISCAL SPACE FOR TAX-FINANCED SOCIAL PROTECTION;

• INCREASING TAX REVENUES

• REALLOCATING PUBLIC EXPENDITURES;

• TACKLING ILLICIT FINANCIAL FLOWS;

• TAPPING INTO FISCAL AND CENTRAL BANK FOREIGN EXCHANGE RESERVES;

• BORROWING OR RESTRUCTURING DEBT

• ADOPTING INCLUSIIVE MACROECONOMIC FRAMEWORKS;

• DRAWING ON DEVELOPMENT ASSISTANCE;

• FINANCING SOCIAL PROTECTION FROM CONTRIBUTIONS;

• CONCLUSION

This is the fourth in a series of policy guides developed to support policymakers and practitioners in Asia and the Pacific in their efforts to strengthen social protection. This guide examines ways to finance social protection, with a focus on tax-financed social security schemes. This policy guide will outline the options for countries to increase investment in social protection through general government revenues. The guide will also briefly discuss social insurance schemes financed through contributions. Ideally, countries should build systems that are funded from both sources to ensure minimum income security for all citizens and residents and to smooth consumption levels over the lifecycle.